How the North Star framework can lead your company to success

The North Star framework is the top-line metrics that all company priorities are aligned around

In early 2010, Sean Ellis, author of Hacking Growth, came up with the term «North Star metric». He was inspired by the star Polaris, which lies directly above the Earth’s Northern pole and has been used as a guiding navigational light for centuries. The point of a North Star Metric is simple: to give teams a definite direction — to align these teams around a singular goal of growth.

Companies adopt the framework to break down their strategies into more straightforward and more memorable terms for teams to understand and apply.

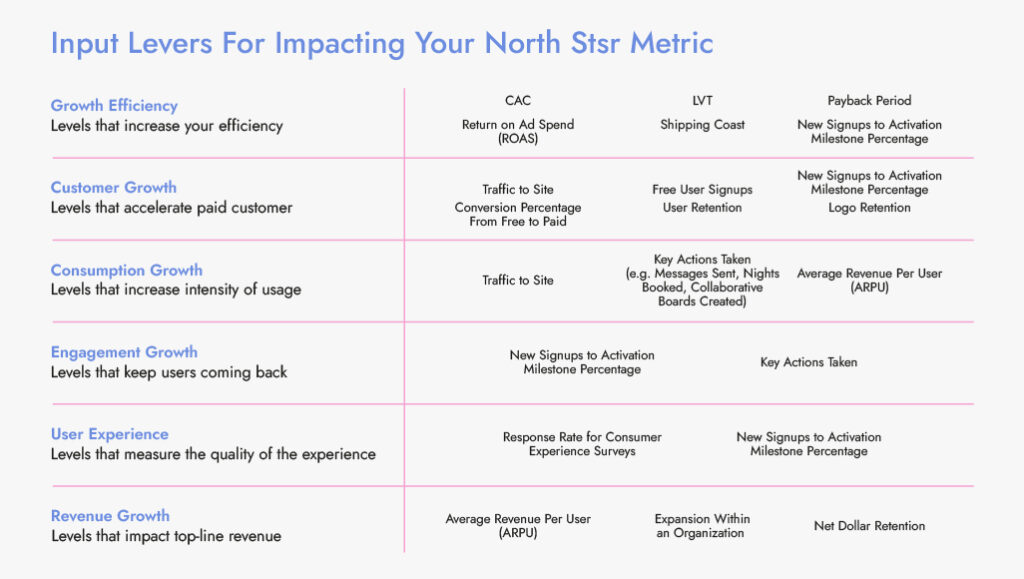

Below are the six main categories of metrics

- Revenue (e.g. ARR, GMV):

- Customer growth (e.g. paid users, market share):

- Consumption growth (e.g. messages sent, nights booked):

- Engagement growth (e.g. MAU, DAU)

- Growth efficiency (e.g. LTV/CAC, margins)

- User experience (e.g. NPS)

How to use it

The famous investor Lenny Rachitsky, in his article «Choosing Your North Star Metric» recommends refining your North Star Metric (NSM) – deciding which of the six categories above to focus on, as it depends heavily on your business model and your product.

Type of company: Marketplaces and platforms

Most common North Star Metric: Consumption growth

Marketplaces and platforms generate revenue through utilization — the greater the utilization they stimulate within their platforms, the quicker they expand. Marketplaces that receive a percentage of each transaction, such as Airbnb, Uber, Lyft, and Cameo, prioritize their NSM on the quantity of transactions (nights reserved, journeys completed, and requests made, correspondingly).

Platforms that, in contrast, impose a fixed charge for each utilization, such as the cloud communications platform Twilio and the financial technology titan Plaid, focus on engagement: in this instance, messages dispatched and financial accounts connected. At an initial glance, it might appear that prioritizing GMV would be the superior option in both of these situations, but directing attention towards revenue as a NSM can be misleading.

Type of company: Paid-growth driven businesses

Most common North Star Metric: Growth efficiency

When your business is steered by performance marketing, there are two prevalent NSMs (North Star Metrics): profitability margins and LTV/CAC (Customer Lifetime Value to Customer Acquisition Cost ratio). Businesses like the meal kit service Blue Apron, the e-commerce bedding company Casper, and telehealth startup Hims all emphasize enhancing profitability margins since they ship tangible products with multiple layers of expenses. The more they earn per unit, the quicker they expand.

On the contrary, companies that are purely digital and allocate most of their budget to performance marketing, like the meditation and sleep app Calm, tend to focus on LTV/CAC because the majority of their expenditure is directed towards digital advertising. Some companies in this category also regard the «payback period» as their NSM to optimize how swiftly they can reinvest in their growth.

Type of company: Freemium team-based B2B products

Most common North Star Metric: Engagement and/or customer growth

This category of products, which encompasses companies like the collaborative online document startup Code and Slack, expands through a bottom-up acquisition model. These enterprises aim to attract free users who subsequently bring in their coworkers. Over time, as businesses attain a certain level of usage, they transition to a paid subscription.

Depending on the stage of development of the business and the extent to which their growth is driven from the bottom-up, these companies either prioritize user involvement (for instance, Coda employs «DAU14», while HubSpot utilizes «WAU»), paying customers (Airtable tracks «Weekly Paid Seats», and Asana monitors «Weekly Active Paid Users»), or paid teams (Slack gauges «Number of Paid Teams», while Dropbox assesses «Teams utilizing Dropbox Business»). The more established and sales-focused the product becomes, the greater the emphasis on customers rather than user engagement.

Type of company: UGC subscription-based products

Most common North Star Metric: Consumption

For select products that are driven by content creation, like Twitch and the video messaging platform Loom, it can be more effective to optimize consumption — say, five-minute plays, or videos created that are viewed — rather than engagement. This is because the sharing and consumption of content are essential for their growth.

Though consumption and engagement are similar metrics, the former is much more active — creating a video, for example, rather than merely visiting the website. Consumption is more likely to result in users sharing the content, thus driving the growth flywheel.

Type of company: Ad-driven businesses

Most common North Star Metric: Engagement

Every company that monetizes through web traffic (by running ads), such as Facebook, Pinterest, and Snap, opts for a North Star Metric based on engagement. The question is whether one focuses on Daily Active Users (DAU), weekly (WAU), or monthly (MAU). Facebook and Snap target DAU because, for better or worse, social media is a daily habit for most. Meanwhile, Pinterest looks at WAU, since it doesn’t expect its users to need the product daily. And Spotify’s podcast business concentrates on MAU, most likely because podcast listening is more sporadic for users.

Type of company: Consumer subscription products

Most common North Star Metric: Engagement or customer growth

Consumer subscription products like the language learning app Duolingo, dating app Tinder, and the exercise tracking app Strava often opt for either engagement or customer expansion as their guiding metric. For instance, Duolingo and Strava both emphasize engagement (e.g., daily active users and monthly active users, respectively) because they possess a substantial free user base that eventually transitions to paid subscriptions. Consequently, the higher the engagement levels of their free users, the more confident they are about acquiring paid customers.

On the other hand, companies such as Tinder, Spotify, and Webflow direct their focus toward customer growth rather than engagement. It’s worth noting that Tinder specifically hones in on the proportion of paid memberships rather than an absolute count. This approach is preferable due to the natural attrition that occurs as people presumably find their life partners. Thus, they benefit more if they can prompt early users to upgrade swiftly. Patreon discovered that fostering successful creators (measured by the number of new creators earning a certain income threshold) was the linchpin of its initial growth cycle. Spotify, which operates both a subscription model (music) and an advertising-based model (podcasts), places its emphasis on engagement, customer expansion, and content consumption.

Type of company: Products that differentiate on experience

Most common North Star Metric: User experience

Some products may win or lose based purely on their user experience — how delightful, easy, and useful their customers find the product. Thus, these types of companies include a quality-oriented North Star Metric.

While Robinhood and Superhuman rely on net promoter scores (NPS) — which reveal how likely a user is to recommend a product — Duolingo looks at a metric it calls «learning competency» using the Common European Framework of Reference for Languages (CEFR), which is the international standard for measuring language ability. They do this because for their product experience, it makes sense to define language proficiency at different levels that match the user’s goals.

Examples

Let’s see how companies use this framework in the examples provided by Artkai’s and Amplitude’s blogs.

Example 1: Spotify

The primary metric that Spotify uses as its guiding star is «subscriber’s music listening time». What sets Spotify’s North Star Metric (NSM) apart is its exceptional quality. It primarily measures the value users derive from the platform, and it can also escalate when metrics related to awareness, user acquisition, or customer retention improve.

As data is provided, Spotify evaluates premium subscription counts, the typical duration of user sessions, the average monthly song shares per user, weekly session counts, and recommendations. The ultimate metric outcome remains constant: the duration users spend engaged in music listening. This NSM empowers Spotify to effectively prioritize its ongoing platform development efforts.

Example 2: Facebook

Facebook’s North Star Metric is «Monthly Active Users» (MAU). People frequently misunderstand Facebook’s NSM as «the number of new friends per week/month» However, NSM identified as «monthly active users» truly represents the value the platform brings to people and the likelihood they will continue using it for an extended period.

Measuring active users proves to be a superior metric for growth compared to new users. Active users are the customers who derive the most benefit from your products. They are more inclined to support the brand and less likely to churn. In contrast, acquiring brand-new customers can entail some risk. Engaging a new user is merely half the battle; retaining that customer is what ultimately matters for revenue. Consequently, Facebook’s NSM stands as the ideal solitary metric for achieving long-term growth.

Example 3: Burger King

The digital division at Burger King applied the North Star Framework to establish a North Star Metric referred to as «Digital Transactions Per User». They also pinpointed three factors: frequency, registration, and new user activation. Subsequently, they formed teams referred to as «squads» to propel these factors forward.

The Burger King teams prioritize and track the initial feature work linked to these factors and then associate it with their «Digital Transactions Per User» North Star Metric. As an example, in order to boost the «frequency» factor, one squad gave priority to a «mobile order exclusive coupons» initiative. All Burger King employees share identical goals: augmenting brand loyalty and revenue. Nevertheless, if they adopt these objectives, they would all twist in diverse directions. The North Star Framework provided the company with guidance, enabling everyone to concentrate on the same objectives.

Example 4: Amplitude

At Amplitude, a primary focal point for their product is the weekly count of users who execute at least one query on the platform. Within the organization, it is referred to as the Weekly Querying Users (WQUs). Additionally, there are performance metrics related to the platform’s infrastructure, which are specifically managed by their backend engineering team.

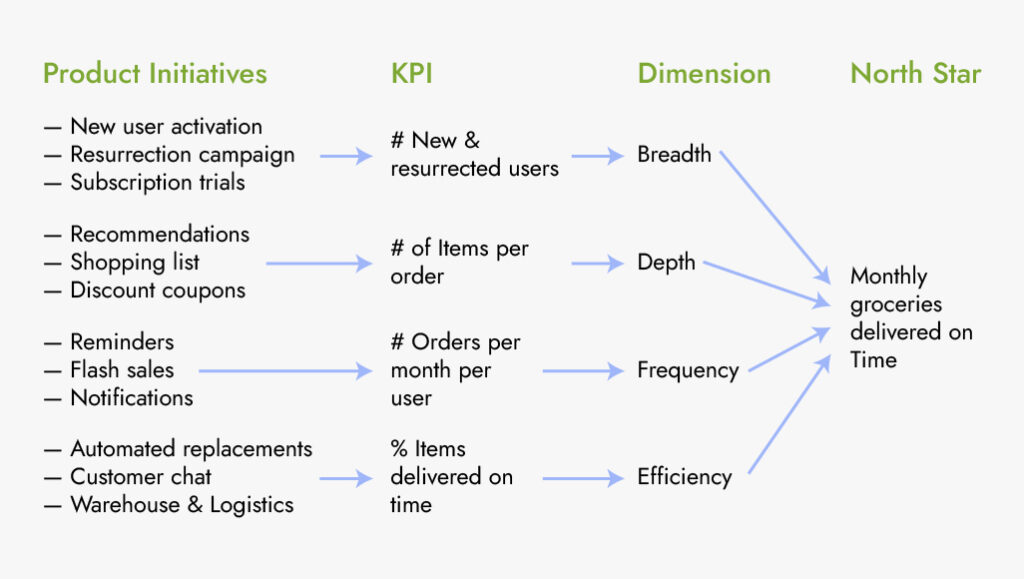

Every central metric like the one at Amplitude can be accessed through four distinct facets: breadth, depth, frequency, and efficiency. For Amplitude’s principal metric, they have given priority to three of these aspects, and they currently have product teams dedicated to advancing them.

Takeaway

The North Star framework is a great tool for focusing the team on the company’s key goals. Check our blog if you want to get acquainted with other useful frameworks.